What is Gift Aid?

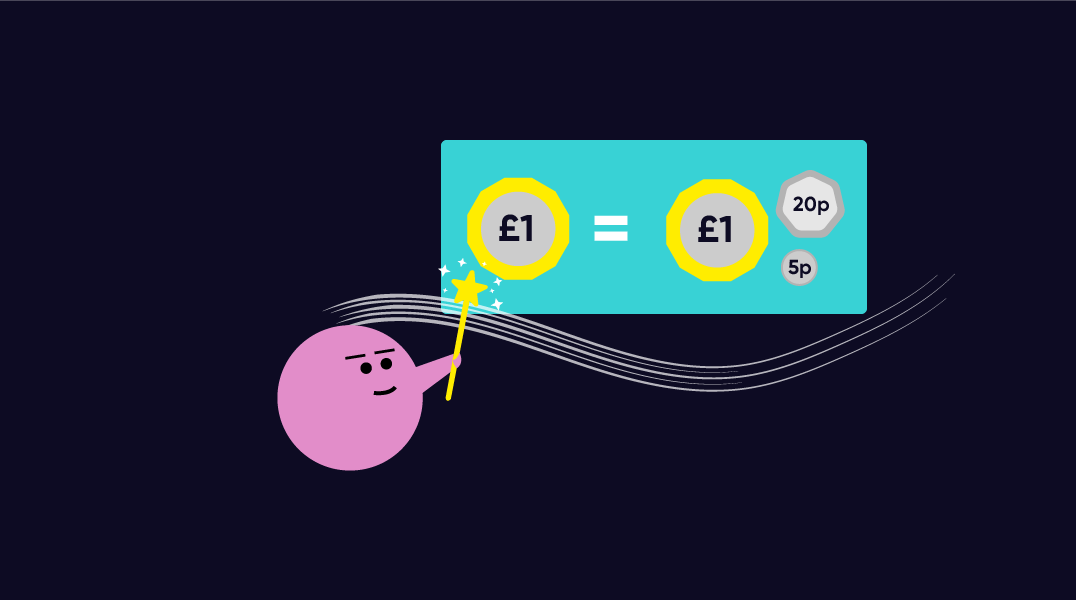

Adding Gift Aid to your donation means we can claim an extra 25p for every £1 you give at no extra cost to you! Boost your donation and support the 1.9 million children who are struggling with talking and understanding words in the UK.

Sign up to Gift Aid

Fill in a Gift Aid form to make your donation go further:

Gift Aid FAQs

Gift Aid is a government scheme that allows charities to claim back the tax you’ve paid on your donation, meaning we will receive 25p more for every £1 you’ve donated, that’s more funds towards incredible causes! (It also doesn’t cost you any extra).

So that we are able to claim the tax back from HMRC we’ll ask you to fill in a short declaration form to check your donation is eligible to claim Gift Aid.

All UK taxpayers are able to declare Gift Aid. That’s right! Your donations will qualify as long as you have paid at least as much in Income Tax or Capital Gains Tax in that tax year as your Gift Aid amount.

Nope! We can also claim Gift Aid on any donations you’ve made to us in the past 4 years and any future donations you make to us, that’s more funding going towards supporting children with speech and language challenges.

Of course! If you need to change your name, address or if you believe you’re no longer paying enough tax to cover the Gift Aid claimed, please drop us an email or give us a call so we can update your information.

Email us at fundraising@speechandlanguage.org.uk and we can help.

Unfortunately, we’re unable to claim Gift Aid on the following donations:

- from limited companies

- made through Payroll Giving

- that are a payment for goods or services

- where the donor gets a ‘benefit’ over a certain limit

- shares

There are some special rules for claiming Gift Aid on certain types of donations such as sponsored challenges, actions and events. If you’re unsure whether your donation is eligible, you can check out the details on the YouGov website.

You can claim back the difference between the tax you’ve paid on the donation and what Speech and Language UK received as Gift Aid. For example if you donate £100 – we can claim Gift Aid to make your donation £125. You pay 40% tax so you can personally claim back £25.00 (£125 x 20%).

Taken from YouGov website

Make a donation